The Financial Freedom Formula: How to Measure and Achieve True Wealth

The Financial Freedom Formula: How to Measure and Achieve True Wealth

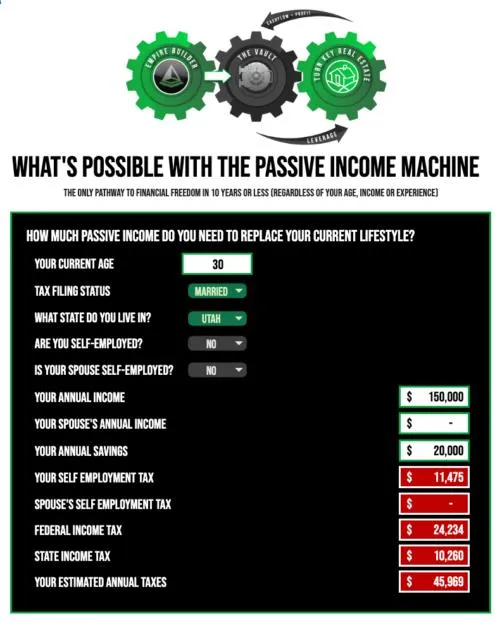

Welcome to Wealth Outside Wall Street, your definitive resource for genuine financial freedom. Today we’ll explore why traditional financial strategies focusing on net worth are misleading and introduce our proprietary Financial Freedom Formula, a powerful strategy for becoming a true investor.

Net Worth vs. Cash Flow: What Truly Measures Financial Success?

Traditional financial advisors emphasize net worth as a primary measure of success. However, net worth alone is a poor indicator of financial freedom because it doesn't reliably translate into sustainable income.

Real financial freedom is better measured by consistent and predictable cash flow.

Would you prefer:

Clearly, consistent cash flow provides greater financial security and freedom. Your goal should always be passive income exceeding monthly expenses.

Introducing the Financial Freedom Formula: The Core 4 and 4 Pillars

To effectively build passive income, your investments must meet certain criteria. We call these criteria the Core 4 and the 4 Pillars.

The Core 4 Criteria

To achieve financial freedom in 10 years or less, investments must:

Control over your investments.

Return on investment (ROI).

Risk exposure.

Tax liability.

For example, mutual funds typically score poorly:

Total Core 4 Score for mutual funds: 0/4

Contrast this with real estate:

Total Core 4 Score for real estate: 4/4

The 4 Pillars of Investment Returns

Successful investments must generate returns through multiple channels. These channels are the 4 Pillars:

Appreciation (increase in value)

Cash Flow (regular income)

Tax Benefits (reducing liabilities)

Leverage (using other people’s money to amplify returns)

Again, mutual funds score poorly:

Total 4 Pillars Score for mutual funds: 1/4

Real estate scores exceptionally well:

Total 4 Pillars Score for real estate: 4/4

Three Assets Meeting All 4 Pillars

There are only three asset classes that consistently meet all four pillars:

Real Estate: Stable, appreciating, tax-advantaged, and leverageable.

Personally-Owned Business: Offers full control, significant ROI, leverage, and tax advantages.

High Cash-Value Life Insurance: Overfunded policies provide guaranteed growth, tax-free benefits, leverage options, and steady income.

The Power of Velocity

The 'V' in our Financial Freedom Formula stands for Velocity. Accelerating your investments through velocity means:

Consider placing your capital in high cash-value life insurance (vault), which simultaneously earns returns across multiple pillars, then leveraging this asset to acquire real estate, compounding your returns further.

Real-World Success: A Case Study

Sean and Haley Beckman, clients within our community, rapidly achieved financial freedom:

Initiated their first policy and acquired their first cash-flowing property within 48 days.

Grew their portfolio to 20 properties over 36 months, enabling Sean to leave his career.

This illustrates the tangible benefits of applying the Financial Freedom Formula.

The Importance of Focus

To achieve financial freedom quickly, intense focus is critical. Diversification is often a strategy used when investors lack control and knowledge. Renowned investor Warren Buffett says, "Diversification is protection against ignorance. It makes little sense if you know what you're doing."

By focusing on the Core 4 and the 4 Pillars, you align your capital exclusively with proven strategies, significantly accelerating your financial independence.

Curiosity Without Constraints: Imagine Your Possibilities

Imagine achieving financial freedom, living without financial constraints, and pursuing your passions freely. Armando Zamora, another success story from our community, describes financial freedom as living a life of “curiosity without constraints.”

Ask yourself:

Take Control Today

You now possess the foundational knowledge and strategy to become a successful investor using our proprietary Financial Freedom Formula. Join us as we continue to explore these powerful strategies in greater depth, helping you secure genuine financial independence.

Related Resources:

RISE UP, LIVE FREE

Wealth Outside Wall Street