The 10-Year Blueprint: How to Build Your Passive Income Machine Through the 4 Phases of Financial Freedom

The 10-Year Blueprint: How to Build Your Passive Income Machine Through the 4 Phases of Financial Freedom

For months, we’ve been building your foundation piece by piece:

You understand why most people stay stuck financially.

You see the limitations of Wall Street.

You’ve learned what it really means to be an investor.

You’ve discovered the 3 gears of the Passive Income Machine:

Becoming an Empire Builder → The VAULT → Autopilot Assets.

Now it’s time to put it all together.

If the gears are the engine, the 4 Phases of Your Game Plan are the flight path—the framework that takes you from where you are to Financial Freedom in 10 years or less.

This is the roadmap that brings order, clarity, and predictability to your money.

Let’s walk through it.

The Framework for Creating Wealth: From Mindset to System

Like many people, my financial journey shifted after reading Rich Dad Poor Dad. It taught me that nearly everything I believed about money was wrong—and that if I wanted different results, I had to adopt a different mindset.

But mindset wasn’t enough.

It wasn’t until I read Creating Wealth by Robert Allen—who would later become a mentor inside the Wealth Outside Wall Street community—that I finally saw a practical framework for achieving Financial Freedom.

One promise from the book changed everything:

If you buy just 2 single-family homes a year for 10 years, your wealth will surprise you.

Robert Allen compared the wealth-building journey to launching a rocket:

90% of the fuel is burned in the first few minutes simply breaking gravity.

Once you're in orbit, gravity works with you rather than against you.

This is the exact model behind the 10-Year Passive Income Machine—a system designed to break financial gravity, get you into orbit, and allow wealth to compound with increasing momentum.

The 4 Phases of Your Game Plan

Over a 10-year journey, every Empire Builder moves through four distinct phases:

1. Pre-Launch Phase

2. Launch Phase

3. Escape Velocity Phase

4. Orbit Phase

Here's how each one works—and what needs to happen inside them.

Phase 1: Pre-Launch — Build the Foundation

This is where clarity, structure, and intention take center stage.

Most people fail financially for one simple reason:

They diversify their attention instead of focusing on the few things that work.

In Pre-Launch, you realign everything. You create order. You stop drifting.

Key Objectives in Pre-Launch:

1. Identify the REAL problem.

If 97% of traditional financial advice leads to failure, the remaining 3% is where wealth is created.

Your job is to focus on that 3%.

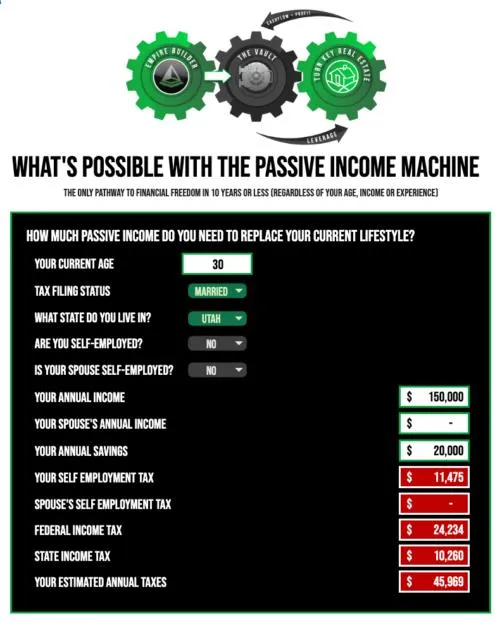

2. Build your Game Plan.

A Game Plan is not wishful thinking.

It’s a math equation:

Income

Savings rate

Assets

Cashflow

Debt

Time horizon

Once you know your numbers, the path forward becomes predictable.

3. Save a minimum of 10%—non-negotiable.

This is the fuel for your financial launch.

4. Reposition your capital OFF Wall Street.

Your money cannot compound inside a broken system.

5. Define your WHY and WHO you must become.

This is what keeps you committed when the work gets real.

6. Build your VAULT.

This is the most critical part of Pre-Launch.

Your VAULT becomes:

Your reserve fund

Your leverage engine

Your future tax-free income stream

Your inflation hedge

Your private banking system

The design must be exact—minimum cost, maximum cash value, maximum long-term income capacity.

Once your VAULT is funded and your foundation is set, you’re ready for Phase 2.

Phase 2: Launch — Begin Building Your Passive Income Machine

This is where the Financial Freedom Formula gets applied.

Your VAULT becomes your bank.

Your savings become fuel.

Your decisions become data-driven.

And your system begins compounding.

Your mission in Launch: Buy your first 3–6 Autopilot Assets.

Here’s how the process works:

Use your VAULT for the 20–25% down payment.

Use the bank’s money (leverage) for the remaining 75–80%.

Validate each property using the Empire Builder Software.

Only buy properties that pass the Core 4 & 4 Pillars test.

(We have an entire blog on evaluating turnkey properties here:

**→ How to Evaluate a Turnkey Single-Family Rental (The Empire Builder Method) **)

This phase is where fear shows up.

“What if I buy the wrong house?”

“What if the numbers don’t work?”

“What if the market shifts?”

Data removes fear.

Your Game Plan removes confusion.

Your VAULT removes risk.

Your team removes overwhelm.

Once you've bought 3–6 properties, your system becomes automatic—and momentum takes over.

Phase 3: Escape Velocity — Scale, Monitor, and Master the System

Escape Velocity is where most investors get off track—but Empire Builders accelerate.

Think of an airplane:

Being one degree off doesn’t matter at takeoff.

But over a thousand miles, that single degree will take you to the wrong country.

The same is true for financial freedom.

Escape Velocity is all about:

Monitoring your actual returns

Tracking progress to your 10-year target

Fine-tuning your strategy

Strengthening your mindset

Decoupling your time from your income

This phase introduces CEO-level financial management:

Cashflow dashboards

Vault tracking

Property performance metrics

Real-time ROI monitoring

Course corrections

This is also where lifestyle enters the picture.

Most people think they have to wait until they’re financially free to live a meaningful life.

Wrong.

Inside Wealth Outside Wall Street, we teach:

Live a life that matters NOW.

Build a system that supports that life FOREVER.

As you begin enjoying the present, your motivation to continue scaling your Passive Income Machine dramatically increases.

This is how you avoid burnout and stay committed for 10 years.

Phase 4: Orbit — The Phase of True Financial Freedom

Orbit is the moment everything you’ve built begins to pay off.

Your 4 Pillars—cashflow, appreciation, tax benefits, and leverage—are now producing significant wealth.

Your VAULT is compounding and poised to deliver tax-free income.

Your real estate portfolio is appreciating and amortizing.

Your system is working for you—not the other way around.

Now your mission changes:

Stop reinvesting all profits

Begin harvesting profit strategically

Convert growth into tax-free lifetime income

Recompose your Game Plan

Stack cashflow to exceed expenses

Shift from accumulation → distribution

This is the moment you experience Financial Freedom—not just mathematically, but emotionally and mentally.

Robert Kiyosaki says:

“Financial Freedom is a choice.”

I believe it’s more than that.

Financial Freedom is Money Mastery.

It’s the ability to make confident financial decisions effortlessly.

It’s having time, autonomy, and intention.

After 10 years of making thousands of small financial choices, you'll reach a point where making the right decision becomes second nature—like tying your shoes.

This is the life you’re building.

This is why the Passive Income Machine exists.

This is what awaits you when you commit.

Next Up: How to Build Tax-Free Income for Life

In the next blog, we’ll break down how to turn your VAULT into a tax-free income stream, and how to design a lifetime distribution plan that keeps you financially free forever.

RISE UP, so that you can LIVE FREE.

— Ryan D. Lee | Wealth Outside Wall Street