How Autopilot Assets (Turnkey Real Estate) Accelerate Your Passive Income Machine

How Autopilot Assets (Turnkey Real Estate) Accelerate Your Passive Income Machine

Real estate is one of the most proven paths to Financial Freedom—but most people pursue it the wrong way. They hustle, grind, rehab, manage tenants, and unknowingly build themselves a part-time job instead of a passive income system.

In Gear #1, we covered becoming an Empire Builder.

In Gear #2, we explored the VAULT and how to build your own private banking system.

Now it’s time for Gear #3 of the Passive Income Machine:

Autopilot Assets — the simplest, most effective, and most predictable path to real estate wealth.

This blog walks you through the mistakes most investors make, the mindset shift the wealthy understand, and how turnkey single-family rentals become the foundation for building Financial Freedom in 10 years or less.

The Painful Truth: Most New Investors Accidentally Build a Second Job

When I first read Rich Dad Poor Dad by Robert Kiyosaki, I knew real estate was my path to Financial Freedom.

What I didn’t know was how to do real estate correctly.

Property #1 felt exciting.

Property #2 felt confusing.

Property #3 gave me an actual panic attack.

I was acquiring real estate the wrong way:

I was finding properties myself.

I was overseeing (and often doing) the rehab.

I was placing tenants.

I was managing the issues.

By property #3, I was no closer to Financial Freedom—

I was closer to a BREAKDOWN.

The breaking point came when a problem tenant created chaos in the neighborhood and even triggered a call from a police officer:

“Son, you’re in some trouble…”

That was the moment I realized:

I wasn’t building passive income…

I had built a part-time job.

And most investors make this same mistake.

The Coaching Conversation That Changed Everything

At that time, I had a mentor who reframed my entire approach.

He shared two lessons straight from the world of the wealthy:

Lesson #1 — The Rich Don’t Work for Money

I thought working harder was the answer.

But the wealthy don’t trade time for dollars—they build systems.

Lesson #2 — Passive Income Requires Leverage, Not Labor

I didn’t have passive income.

I had a “real estate side hustle.”

My mentor said:

“Passive income means you do the work once and get paid forever.

Trading hours for rent checks is never passive.

There is a smarter path.”

That smarter path?

Turnkey real estate.

Or what we call Autopilot Assets.

What Are Autopilot Assets? (AKA Turnkey Real Estate)

Autopilot Assets are properties where:

Experts find the deals

Experts renovate the homes

Experts place the tenants

Experts manage the properties

Experts handle repairs and evictions

You own the asset.

You receive the cashflow.

You control the long-term wealth.

But you do NOT do the work.

Here’s how a typical turnkey provider operates:

They acquire distressed or undervalued properties.

They evaluate repair costs and after-repair value (ARV).

They complete the renovation (new paint, flooring, roof, kitchens, etc.).

They prepare it for rent.

They sell it to you at market value.

They manage it for you long-term.

They profit from selling a finished product.

You profit from the next 10+ years of ownership.

Why Autopilot Assets Win: The Five Profit Centers

When you buy the right single-family rental (SFR) with the right team, you benefit from:

1. Cashflow

Monthly income that grows over time.

2. Appreciation

The property becomes more valuable every year.

3. Tax Benefits

Depreciation, write-offs, and long-term tax advantages.

4. Debt Paydown (by the tenant)

Your renter pays off your mortgage for you.

5. Equity Growth + Cash-Out Refinances

You can pull out growth tax-free.

Turnkey real estate consistently produces 20–50% annual returns when all profit centers are combined.

That’s why it’s the boring but most effective path to Financial Freedom.

Why Single-Family Homes Are the Most Profitable (and Most Overlooked) Asset

The wealthy often chase complex deals:

multifamily, commercial buildings, syndications, mobile home parks…

Meanwhile, the best-kept secret in real estate wealth is:

Single-family homes (3 bed / 2 bath / middle-class neighborhoods)

Why?

Most undervalued asset class

Most underbuilt for 20 years

Most demanded by renters

Most stable during downturns

Most predictable cashflow

Most accessible financing

Most recession-resilient

Even Warren Buffett said:

“If I could buy 200,000 single-family homes right now… I would.”

This is the Moneyball strategy for wealth:

Stop trying to hit home runs.

Just keep hitting singles.

Instacart Your Real Estate: How Turnkey Real Estate Works Today

Think about how Instacart works:

You choose your grocery store

You pick your items

Someone else shops

Someone else delivers

You get the result without doing the work.

Turnkey real estate is the Instacart of wealth-building:

Pick your market

Pick your property

Turnkey provider shops the deal

Turnkey provider delivers a rent-ready asset

Property management handles everything

You collect cashflow and build long-term wealth

You can now invest anywhere in the country from anywhere in the world.

I personally live in Utah, but my portfolio spans Arizona, Texas, Tennessee, Florida, and more.

Real Results: Julie’s Story

Julie was a real estate professional earning good money—

but she wasn’t free.

When she discovered Autopilot Assets and the Passive Income Machine:

She built a portfolio of single-family rentals

She paired them with her VAULT

She implemented her 10-year game plan

She retired her husband

She travels the world

She lives a purpose-driven life

Today, she is financially free.

And her story is one I’ve seen repeated thousands of times.

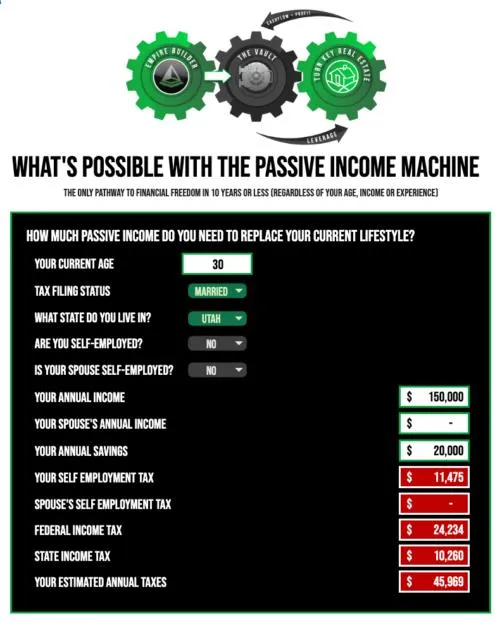

You Now Have All Three Gears of the Passive Income Machine

Gear 1: Become an Empire Builder

Control your income and mindset.

Gear 2: The VAULT

Become your own bank and create unstoppable compounding.

Gear 3: Autopilot Assets

Buy 20 single-family homes with the right team and the right system.

This is the blueprint for achieving Financial Freedom in 10 years or less.

Next time, we’ll break down The 4 Phases of Your Game Plan and how to put these gears into motion step-by-step.

RISE UP, so that you can LIVE FREE.

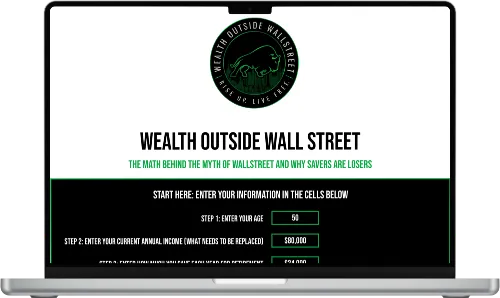

— Ryan D. Lee | Wealth Outside Wall Street